Implementing such a system allows for improved financial management. By tracking where money is spent, businesses gain insights into spending patterns, enabling them to identify areas for potential cost savings. This promotes better budget allocation and resource utilization, leading to increased profitability and financial stability. The availability of organized expense data simplifies the process of applying for loans or seeking investment.

expenses

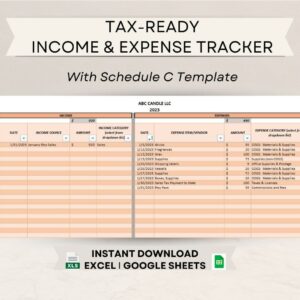

Sch C Expenses List Template

Implementing such a tool streamlines the tax preparation process. It fosters accurate financial record-keeping throughout the year, minimizing errors during tax filing. By providing a clear audit trail of expenses, it supports potential scrutiny from tax authorities. Moreover, consistent usage can lead to greater awareness of spending patterns, facilitating better financial management and informed business decisions.

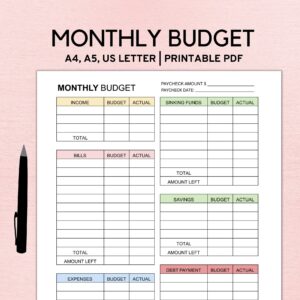

Itemized Monthly Expenses List Template

The advantages of employing such a tool are numerous. It facilitates accurate budgeting, aids in identifying areas where spending can be reduced, and improves overall financial awareness. Furthermore, it can be invaluable for tracking progress toward financial goals and for tax preparation purposes, providing a comprehensive record of deductible expenses.