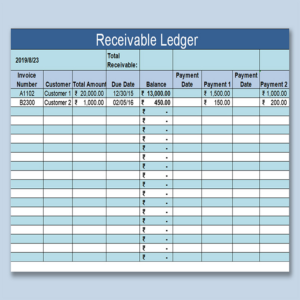

Employing such a structured format offers several advantages. It enables businesses to monitor cash flow, identify potential payment issues early on, and improve overall financial forecasting. Furthermore, it streamlines auditing processes and supports compliance with accounting standards. Effective use allows for better negotiation with both those owed and those owing, contributing to improved financial stability.